Myanmar Market Outlook 2020

Five sectors that will drive growth in the fast-expanding Myanmar economy this year

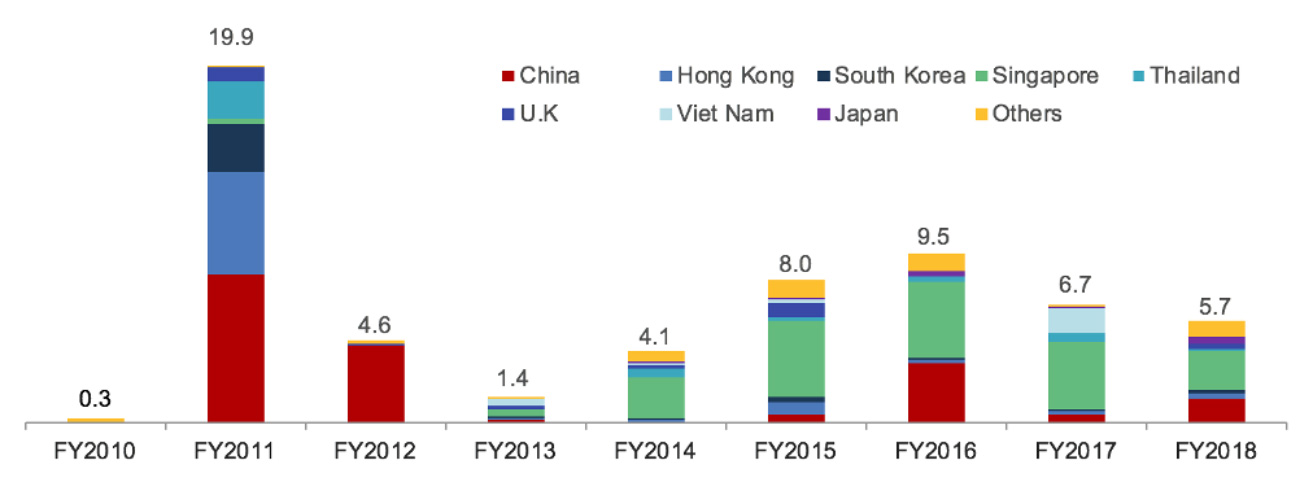

Myanmar has long been on the radar for both global and regional investors keen to strengthen their presence in Southeast Asia. A renewed sense of business optimism resulting from the economic and political liberalisation of the country, has led to an influx of foreign firms and strong economic growth, primarily driven by foreign direct investment (FDI). Singapore has firmly established itself as a key trading and investment partner of Myanmar, as reinforced by the Bilateral Agreement on the Promotion and Protection of Investments between the two countries recently signed in September 2019. Singapore’s share of FDI in Myanmar increased from 1% in financial year (FY) 2011 to 57% in FY 2017 and 38% in FY 2018. Singapore was the largest investor in FY 2018 (US$2.2 billion), followed by China at 24% (US$1.4 billion).

FDI Share in Myanmar by Country (US$ billion)

Source: Directorate of Investment and Company Administration Myanmar, YCP Solidiance Analysis

Myanmar has moved up six places to 165th on the World Bank’s 2020 ease of doing business ranking in the Bank’s latest report, citing substantial improvements in five areas—starting a business, dealing with construction permits, registering property, protecting minority investors and enforcing contracts. We have identified below five sectors that will be the key drivers for economic growth in Myanmar in 2020.

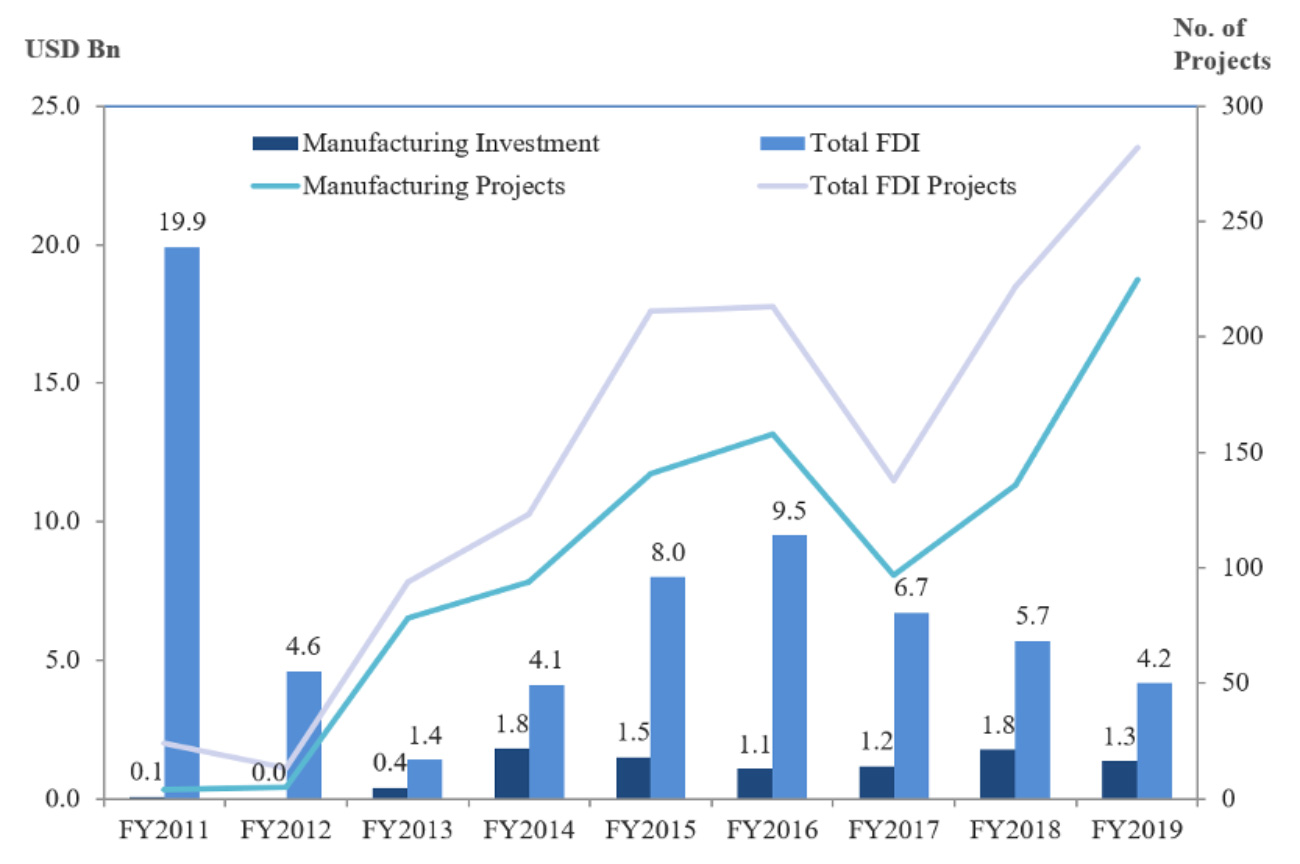

1. Manufacturing: Transition towards more complex manufacturing

The manufacturing sector accounts for a significant share of approved FDI in Myanmar, contributing 32% overall in FY 2019 compared to only 0.3% in FY 2011 by value. Additionally, with the Government promoting import substitution and export promotion sectors to address the significant trade imbalance, manufacturing investments are gradually transitioning from labour intensive low-cost manufacturing to more complex manufacturing, such as automotive assembly. Key automotive original equipment manufacturers (OEMs) with current or confirmed automotive assembly factories in Myanmar include Toyota, Kia, Nissan, Suzuki, Ford and Hyundai.

Approved FDI in Manufacturing Sector

Source: Myanmar Investment Commission, YCP Solidiance Analysis

2. Infrastructure: Double-digit growth supported by over 200 projects in the pipeline

The infrastructure segment accounts for the majority share in Myanmar’s construction output by value, while industrial is the fastest-growing segment. Despite substantial investments in crucial infrastructure such as Special Economic Zones (SEZs) that are needed to drive economic development, the lack of supporting infrastructure continues to be one of the biggest challenges for investors in Myanmar. Electricity shortages, lack of sufficient highways or widespread cross-country road networks especially beyond the Tier 1 and Tier 2 cities, low urbanisation, high reliance on the Yangon port, poor domestic rail infrastructure, negligible waste and water management are among the key challenges that put an upward pressure on operational costs. The Asian Development Bank (ADB) estimates that over US$200 billion will be required through 2030 for improvements in transport, energy, urban and telecommunications infrastructure.

Infrastructure will continue to be a key driver for the construction sector, with growth between 2018 – 2022 estimated at 10.7% and supported by 251 infrastructure projects listed in the project bank launched by the Myanmar Government in January 2019.

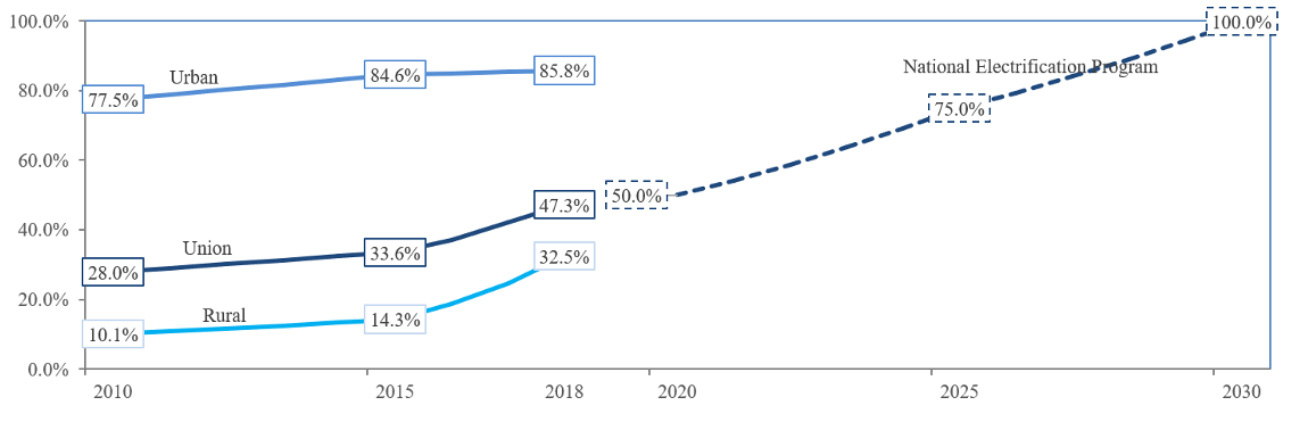

3. Energy: Private investment opportunities in power

Myanmar currently has a low national electrification rate of 47.3%, with hydropower accounting for over 55% share, followed by natural gas at 42%. Per estimates by the World Bank, an additional 7.1 million of Myanmar’s current rural population will move to its cities by 2050, indicating the need for a more integrated power infrastructure. While the country aims to achieve 100% electrification by 2030, private investment in the power sector remains limited, presenting a significant challenge to sustain the economic growth momentum.

Electrification Rate in Myanmar

Source: Ministry of Energy, YCP Solidiance Analysis

4. Healthcare: Rising demand for international quality services

Myanmar is witnessing rising demand for better quality healthcare services driven by an increase in disposable income, higher health awareness and a growing middle class. The public healthcare sector accounts for the bulk (1,134 hospitals) of total hospitals in Myanmar ,while the private sector accounts for a lower share at over 200 hospitals, but the number is growing rapidly. However, many affluent Burmese citizens prefer to visit Bangkok for medical treatment, with Burmese accounting for one of the largest non-Thai customer base for leading Thai hospitals such as Bumrungrad Hospital, Bangkok Hospital and Samitivej Hospital. Key hospitals from Singapore with a current or confirmed presence in Myanmar include Tan Tock Seng Hospital, Parkway Hospital and Raffles Hospital, amongst others. However, the market remains largely untapped with substantial opportunities for foreign investors with the Ministry of Health & Sports aiming to implement universal health coverage programme nationwide by 2030.

5. Services: Driven by recent liberalisation in the financial and insurance sectors

Myanmar’s financial sector is undergoing rapid growth with the insurance segment anticipated to achieve a potential market size of US$2.7 billion in the next 10 years, as the Government allows foreign investment supported by gradual lifting of regulatory restrictions. In April 2019, five foreign companies – Prudential, AIA, Daiichi Life, Chubb, and Manulife – have been authorised to establish wholly foreign-owned entities, along with other recently approved foreign company joint ventures (JVs). Financial inclusion is also becoming a key priority for the government, as the country moves ahead with its economic transition. This is further supported by the rising penetration of mobile phone connectivity, which has led to the emergence and widespread acceptance of mobile money transfers.

The writer is Naithy Cyriac, Managing Director at YCP Solidiance, an Asia-focused advisory and investment firm with 20 offices across the globe.

The writer is Naithy Cyriac, Managing Director at YCP Solidiance, an Asia-focused advisory and investment firm with 20 offices across the globe.