Exporting Next-Generation Cleaning Solutions

Local cleaning technology firm SmartClean Technologies is looking to broaden its global footprint after having found success in India.

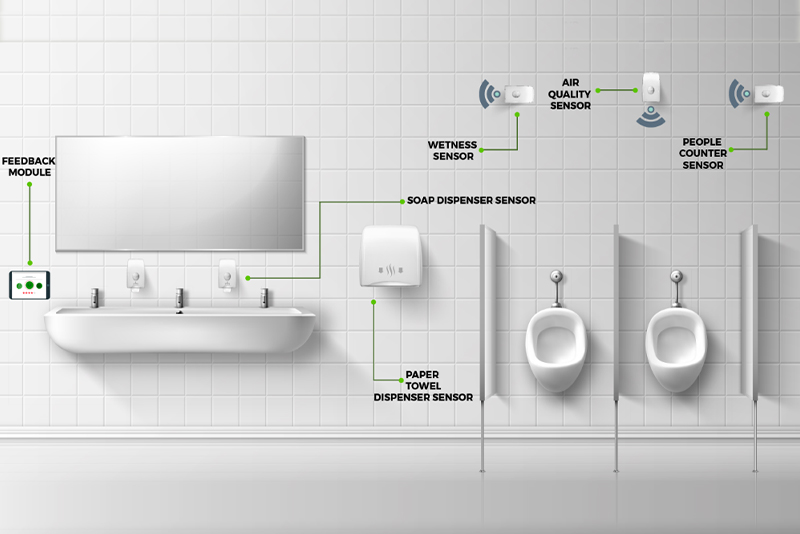

Founded in 2017, Singapore-based SmartClean is looking to disrupt the cleaning industry with its suite of technological solutions that are designed to both digitise and digitalise the sector’s entire value chain – from procurement to the monitoring of cleaning processes and measuring hygiene levels. A B2B proptech company specialising in end-to-end digital cleaning and productivity solutions, SmartClean’s products are driven by IoT (Internet of Things) technology and help to improve productivity and save costs for property owners.

Leveraging Singapore as a testbed for its services, the firm started its international drive in 2018 when it set up operations in India. It has since expanded to Malaysia, Indonesia, and the UAE, and has its sights set on the United States and Australia. SmartClean founder Lav Agarwal talks to BiZQ about his firm’s internationlisation strategy, and his plans to become the Grab of the cleaning industry.

What was your motivation for expanding overseas, and why did you choose India as your first market?

Singapore provides a perfect testbed for us to test a solution. However, we need to internationalise to scale up as Singapore is a small city. We chose India as our first market as we wanted to test our solutions in a market with relatively low labour costs. India is also one of the largest infrastructure markets in Asia.

What has your progress in India been like?

We started in early 2018 and have been able to land contracts for 60 buildings across India, including some Fortune 500 clients. Currently, almost half of our revenue comes from India. This year, most of the offices have been forced to close and some of our contracts are frozen due to the multiple lockdowns and remote work arrangements. However, we have a pipeline of over 200 buildings in India planned for the rest of this year and next.

Beyond India, we have identified the United States (US) as another market with one of the largest cleaning ecosystems. It is comparable to Singapore as it has a very structured market, albeit around 50 to 70 times the size of Singapore. Our company is already incorporated in the US. We also have some ongoing trials in Australia.

What were some of the risks and challenges that you faced in internationalising and how did you overcome them?

One challenge, especially when we enter a new market on our own, is having to comply with the rules and regulations, and to manage the nitty gritty of running a business on a day-to-day basis in a new country. It involves setting up a lot of new processes and hiring new people.

To overcome these challenges, we have tied up with local partners in some markets. When the operations grow to a certain size, we will then incorporate in the country and set up the processes. We also had to evaluate the risk of retrieving the physical IoT sensors that we install in a property with a subscription model, as well as the risk of payments. Again, having a trusted and reliable local partner will help us overcome this.

So, we assess all these variables before deciding whether to enter a new market on our own, or with a partner.

How have your customers benefited from your IoT solutions?

One obvious outcome is an improvement in service quality. The property manager or facilities manager has almost no day-to-day visibility into how a cleaning operation is running. They are only alerted of issues when they receive complaints from the tenants which is not ideal. Our system gives these managers real-time visibility into how the cleaning is progressing and what issues should be resolved immediately to enhance the customer experience.

Our solution also helps with cost control and manpower because cleaners spend 30% to 50% of their time on checks and inspections even when there are no issues. Finally, our system helps improve productivity, helping to reduce the number of cleaners required to get the job done by 30%. So, the savings directly justifies the return on investment (ROI) on the solution.

How do your solutions help change perceptions of the cleaning industry?

Being a cleaner is often seen as a dead-end job with little or no career prospects. However, tech adoption can completely change how the industry is perceived. Over the next one to two decades, the industry is moving towards using more robotics or automated cleaning solutions. Cleaners would no longer be seen as doing a ‘dirty job’ and their role will transform into that of a tech operator. However, such a change will take time and cleaners will also need to upskill to fulfil these new roles.

What are SmartClean’s expansion plans going forward?

We are building a demand-based model for the industry which we will launch in the next year or two. Currently, a cleaner who performs well gets paid the same as one who may be less competent. There is no incentive for a cleaner to do a better job. Similarly, a cleaner who scrubs the toilet is also paid the same as one who is doing a light touch up of a workstation or a pantry.

We aim to transform the cleaning ecosystem into an on-demand or aggregator model, where a cleaner gets paid based on their assigned tasks. For example, a cleaner doing a simple clean-up of the pantry may be paid just S$6 or S$7 an hour, while a cleaner cleaning toilets may be paid S$20 or S$30 an hour. This model will improve service quality and considers the difficulty level of the respective job assignments.

Under our model, we work directly with the property owner to estimate the amount of cleaning and manpower required. We will then draw from an aggregated workforce to meet the needs of the customer. This workforce will be sourced from a cleaning company or from freelance cleaners. This is like Grab’s transportation business, and we strive to create this model for the cleaning industry.